- Sponsored Content

For the past 75 years, ANZA has played a vital role in connecting expatriates and creating a sense of community in Singapore for individuals and families from Australia, New Zealand and many other nations. A large part of my role as a financial advisor with Select Investors, is working with our clients to build long-term partnerships and work towards what could be 75 years worth of planning. This ranges from retirement planning to education fee planning for your children, all the way through to legacy planning.

As we celebrate ANZA’s birthday, I thought it would be good to investigate how investing for 75 years can make a difference to your financial wellbeing.

Looking back

If we look back at life in Singapore in 1948, it was still a separate crown colony with a civil administration. Singapore’s main trading was through tin and rubber which brought economic recovery to Singapore post WW2.*

Investing for three quarters of a century might sound impossible, but it is not. ANZA Singapore is a testament to this: over the last 75 years, it has grown into a dynamic organisation. Similarly, investing in the stock market for 75 years can lead to substantial wealth creation.

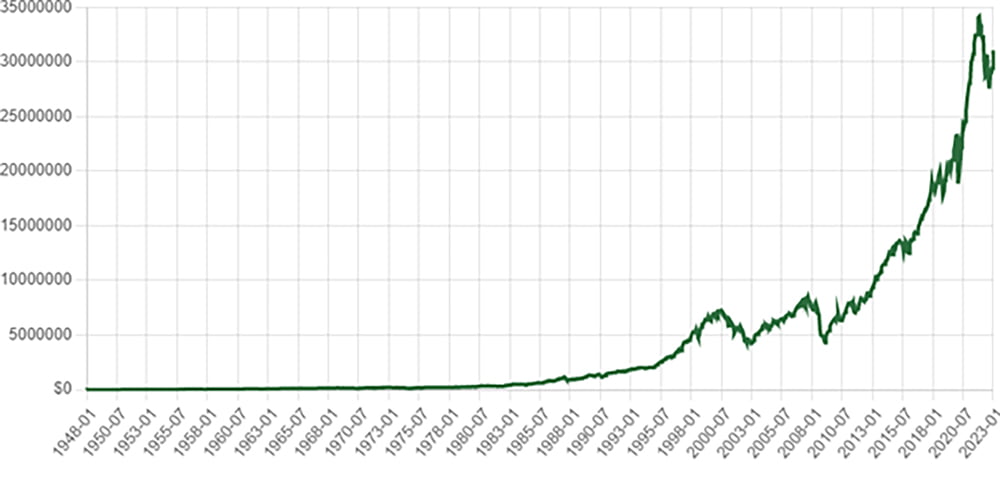

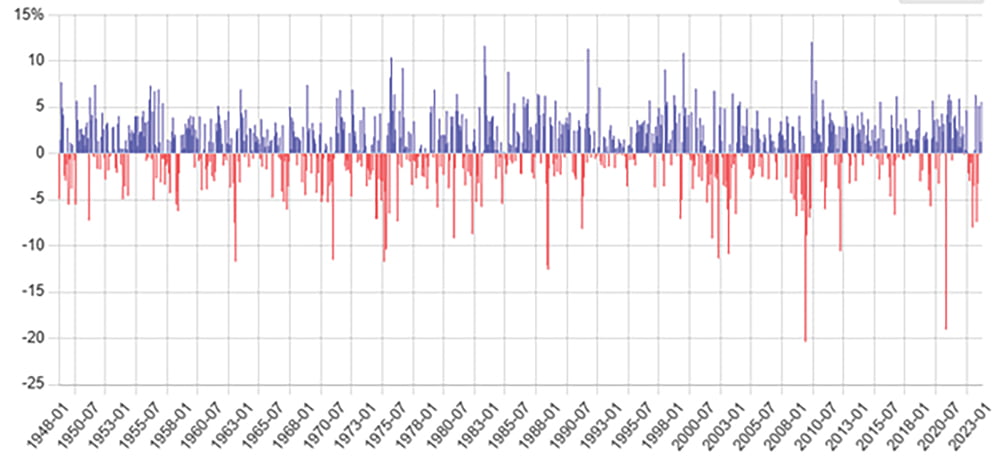

For instance, if you invested $10,000 in the S&P 500 Index in 1948, your investment would be worth over $32 million today.** That is an astounding 310,278.88% return on investment. Over the years there have been positive and negative days. If we look at key issues that have taken place in the last 75 years which may have impacted on the return negatively there have been many: wars, global recessions, many bear markets and a global pandemic.

Global inflation

Over the past year, there has been media attention on global inflation figures, which erodes the value of your money over time. Investing in a diversified portfolio of stocks, bonds, and other assets can help you weather market volatility and achieve consistent returns over the long-term.

If we’re to take inflation into account in the above scenario, you would still achieve a return of 24,682% or roughly a figure of $2,468,210 in 1948 dollars.**

It’s also essential to remember that time is a valuable asset when it comes to investing. The longer you commit, the more time your money has to grow and compound. Albert Einstein famously referred to compounding as the “eighth wonder of the world.” He believed that those who understand compound interest earn it, while those who do not pay it. As ANZA Singapore turns 75, it’s a reminder of the benefits of long-term investing which requires patience, discipline, and a long-term perspective. By remaining invested in the stock market for 75 years, you can achieve returns that can help you achieve your financial goals and create generational wealth.

Jamie Burgmann is a Partner with Select Investors, a Partner Practice of St. James’s Place, and works closely with expatratiates during their Singapore journey and beyond.

Jamie Burgmann is a Partner with Select Investors, a Partner Practice of St. James’s Place, and works closely with expatratiates during their Singapore journey and beyond.

The value of an investment with St. James’s Place will be directly linked to the performance of the funds selected and may fall as well as rise. You may get back less than you invested.

If you would like to reach out for a complimentary review of your personal financial situation, please email jamie.burgmann@sjpp.asia or +65 91679634 to arrange a consultation.

The ‘St. James’s Place Partnership’ and the titles ‘Partner’ and ‘Partner Practice’ are marketing terms used to describe St. James’s Place representatives. Members of the St. James’s Place Partnership in Singapore represent St. James’s Place (Singapore) Private Limited, which is part of the St. James’s Place Wealth Management Group, and it is regulated by the Monetary Authority of Singapore and is a member of the Investment Management Association of Singapore and Association of Financial Advisers (Singapore). Company Registration No. 200406398R. Capital Markets Services Licence No. CMS100851.

The ‘St. James’s Place Partnership’ and the titles ‘Partner’ and ‘Partner Practice’ are marketing terms used to describe St. James’s Place representatives. Members of the St. James’s Place Partnership in Singapore represent St. James’s Place (Singapore) Private Limited, which is part of the St. James’s Place Wealth Management Group, and it is regulated by the Monetary Authority of Singapore and is a member of the Investment Management Association of Singapore and Association of Financial Advisers (Singapore). Company Registration No. 200406398R. Capital Markets Services Licence No. CMS100851.

St. James’s Place Wealth Management Group Ltd Registered Office: St. James’s Place House, 1 Tetbury Road, Cirencester, Gloucestershire, GL7 1FP, United Kingdom. Registered in England Number 02627518.

*nationsonline.org/oneworld/History/Singapore-history.htm

**officialdata.org/us/stocks/s-p-500/1948?amount=1&endYear=2023