- Sponsored Content

Australian superannuation is a long-term savings plan for retirement. Whilst you’re an expat working outside of Australia, you no longer receive superannuation contributions from your employer and many of you will start to question if you have enough in your super for retirement.

As a non-resident, you can continue to make superannuation contributions to superannuation funds in Australia. However, you are not allowed to have a self-managed superannuation fund (SMSF) as the SMSF will be non-complying, and this can result in paying as much as 45% tax.

If you do not have any Australian assessable income, any superannuation contribution would be a non-concessional contribution and this forms the tax-free component. The non-concessional contribution annual cap for the 2024 financial year is $110,000.

When you have a property in Australia that is net positive after taking into consideration depreciation expenses, you can consider making a concessional contribution to reduce the tax payable. The deduction is only to the extent that it would reduce taxable income to zero. The concessional contribution cap for the 2024 financial year is $27,500. Income derived from interest, unfranked dividends, and royalties are subjected to withholding taxes in Australia and a tax deduction cannot be claimed against this type of income.

A minimum upfront savings of 17.5% is attractive, but you must take into consideration the ongoing 15% tax on investment earnings during the accumulation phase. For each contribution, the rules around age, contribution caps, transfer balance cap, and division 293 impact must be considered.

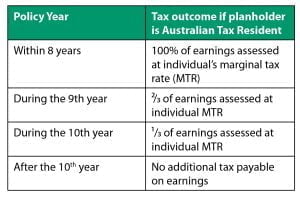

If you have the intention to ultimately reside in Australia, one alternative strategy is to hold investments through an investment-linked life-insurance bond where any withdrawals after 10 years are tax-free. As long as the contribution does not exceed 125% of the previous year’s contribution, it will be considered part of the initial investment. This means each additional contribution does not need to be invested for the full 10 years to receive the full tax benefits.

If the contribution exceeds 125% of the previous year’s investment, the start date of the 10-year period will reset to the start of the investment year in which the excess contributions are made. You will then have to wait for a further 10 years from this date to gain the full tax benefit.

Any withdrawals made whilst you are a Singapore tax resident is tax-free. If you are residing in Australia, tax is payable on withdrawal.

It is important to compare this against your investment timeline and horizon. Unlike superannuation, access is not based on reaching retirement age, therefore providing you with more flexibility. Superannuation can be complicated, so make sure you reach out to a professional to discuss your contributions before you make them.

The levels and bases of taxation and reliefs from taxation can change at any time. The value of any tax relief depends on individual circumstances. You are advised to seek independent tax advice from suitably qualified professionals before making any decision as to the tax implications of any investment. The value of an investment with St. James’s Place will be directly linked to the performance of the funds selected and may fall as well as rise. You may get back less than the amount invested.

Please contact Diana on diana.chua@sjpp.asia or +65 8807 2552 if you would like her to provide guidance on Australian tax matters or would be interested in a complimentary review of your personal financial situation together with one of our wealth planners.

The ‘St. James’s Place Partnership’ and the titles ‘Partner’ and ‘Partner Practice’ are marketing terms used to describe St. James’s Place representatives. Members of the St. James’s Place Partnership in Singapore represent St. James’s Place (Singapore) Private Limited, which is part of the St. James’s Place Wealth Management Group, and it is regulated by the Monetary Authority of Singapore and is a member of the Investment Management Association of Singapore and Association of Financial Advisers (Singapore). Company Registration No. 200406398R. Capital Markets Services Licence No. CMS100851.

The ‘St. James’s Place Partnership’ and the titles ‘Partner’ and ‘Partner Practice’ are marketing terms used to describe St. James’s Place representatives. Members of the St. James’s Place Partnership in Singapore represent St. James’s Place (Singapore) Private Limited, which is part of the St. James’s Place Wealth Management Group, and it is regulated by the Monetary Authority of Singapore and is a member of the Investment Management Association of Singapore and Association of Financial Advisers (Singapore). Company Registration No. 200406398R. Capital Markets Services Licence No. CMS100851.

St. James’s Place Wealth Management Group Ltd Registered Office: St. James’s Place House, 1 Tetbury Road, Cirencester, Gloucestershire, GL7 1FP, United Kingdom.

Registered in England Number 02627518.