- Sponsored Content

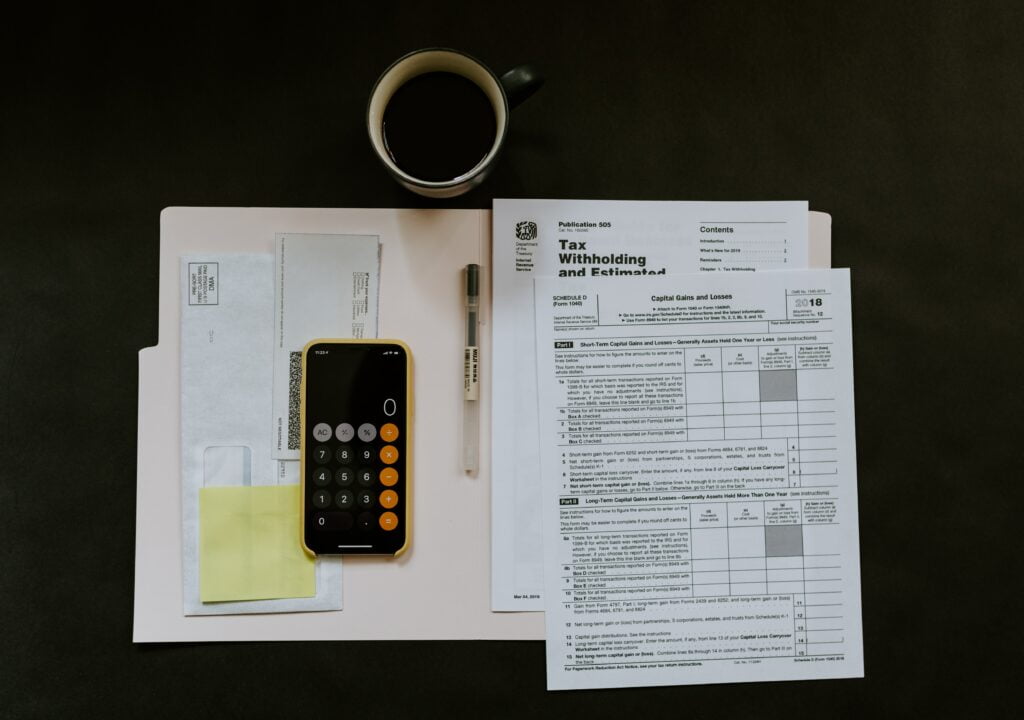

While tax planning for the end of the Australian financial year may feel as exciting as getting prospective root canal treatment, it’s important to be mindful of the closing date of 30 June 2022 and to know exactly where you stand when it comes to your finances.

Many expats feel that there’s not much point in doing doing end of Australian financial year tax planning now they’re living overseas, but and even though tax in Australia may not be as much of a concern for those who have left, they could be leaving tax savings on the table and as they say, a penny saved is a penny earned.

Read on for some tax planning tips for the end of the Australian financial year from our friends at Select Investors. If you’re an expat in Singapore especially, read on!

1. Don’t forget superannuation

If you have a positively geared rental property back in Australia, then you are likely paying non-resident tax at 32.5%+ with no tax-free threshold on your net income, which is unpleasant. Accordingly, you can consider making a deductible superannuation contribution of up to A$27,500 before 30 June which can be claimed as a deduction against your rental income in the same year, thus saving you 32.5% tax at the individual level. This does however get taxed at 15% within your superannuation fund on the way in, and 15% annually on its earnings up to retirement, however there is a net saving of 17.5% together with the fact that you are putting some funds towards your retirement. Furthermore, from 1 July 2018, you can carry forward any unused “concessional” contributions year meaning that you could contribute up to $102,500 this year (to 30 June 2022) if you did not make any contributions in the last four years providing your super balance is less than $500k. Superannuation can be complicated and therefore it is important to reach out to a professional like myself to discuss your contributions before you make them.

2. Get a depreciation report

If you have a rental property back home and do not have a depreciation report, it is worth considering this if the property was constructed after 15 September 1987 or had substantial renovations after this time. Depreciation is a deduction for the reduction in value of the construction (not the land!) for up to 40 years of the property together with the plant and equipment, and furniture and fittings. I recommend reaching out to a quantity surveyor such as BMT or Tax Shield to discuss your specific property and determine whether it is worthwhile commissioning a report. Furthermore, the cost of the actual report is deductible so if you pay for this pre 30 June, you may claim a deduction. You can also amend some of your old returns to do a back claim after the report is produced which could potentially pay for the cost of the report in refunds.

3. Give your share portfolio some love

For those expatriates who may have been holding shares when they moved away from Australia and never elected a “deemed sale” for tax purposes in that particular year, these shares will still be taxable in Australia on sale. Accordingly, year end presents opportunity to sell (and buy back) any shares at a loss to crystalise the Australian capital loss (and potential gains against the loss as well). If you buy them back as a non-resident, you then pay no further tax on the gains as a Singapore tax resident until you move back to Australia again.

4. Push back Australian sourced income and bring forward expenses

This is always the fundamental principal of tax planning as you approach 30th of June each year, even as an expatriate. As an Australian non-resident for tax purposes, you are only taxed on your Australian sourced income and assets, which is, for most of us, Australian property, and any shares which we acquired in Australia and were not “deemed” sold when we moved. So, applying this principal to your property, generally you cannot defer rent, but any expenses which you may have to pay, ensure to pay them pre 30th of June including for repairs and maintenance work, and other expenses like land tax and depreciation reports. Furthermore, Australian based Income Protection Insurance premiums are also deductible against your Australian rental property.

5. Don’t sell your former family home whilst you are offshore

More a point to note however the Capital Gains Tax Principal Place of Residence Exemption was removed from 30 June 2020 for “Foreign Tax Residents”. This means that if you sell your former family home as a non-resident now going forward, you will be taxed on it with no principal place of residence exemption allowed. Important action is to either hold onto it until you return back to Australia as a tax resident again OR sell it in the future but be aware that you will have no tax concessions allowable under this provision. Some exemptions do apply for divorcing couples and other major life events.

6. Lookout – land tax!

It is important to ensure that your property back in Australia is no longer listed as your principal place of residence for land tax purposes, as you will be liable for land tax on this if you are not living in it.

7. Keep your family trust in good order

For those few that may still have an Australian discretionary trust active, ensure that you prepare your trust distribution minutes by the 30 June.

8. Leave in better shape than you arrived

In the event that you are an expatriate and considering a move back to Australia within the next 24 months, it is well worth commencing repatriation planning to ensure you understand the effect of bringing back your assets into a jurisdiction which taxes you on worldwide income and worldwide assets. This would include review of the tax position of each of your assets and income, together with restructuring opportunities, Australian tax residency position, treatment of those assets which will remain offshore and ensuring you have a retirement plan in place as your income in Australia will most likely drop and income tax will increase.

9. Keep an eye on Albo’s future tax changes including Residency

Potential changes to the Australian tax residency rules were announced in the 2021 budget which have currently not progressed to consultation. We expect to see these re-emerge post-election and will be largely tested on the number of days you are in Australia. They could have a sting in their tail so it is important to keep a look out for the changes when they occur.

Please reach out if you would like an obligation free meeting to further discuss any questions you may have via email: [email protected] and do watch the recent on demand webinar to learn more about Australian tax planning.

The above information is general in nature and could vary depending on your personal circumstances. Do contact me if you have any questions about any of the above or for an obligation free discussion to talk more specifically about personal circumstances.

I

I The volunteers get together at the Salvation Army Family Support Services centre in Tiong Bahru three Tuesday mornings each month, where they meet with staff who’ve already packed up two supermarket bags per recipient.

The volunteers get together at the Salvation Army Family Support Services centre in Tiong Bahru three Tuesday mornings each month, where they meet with staff who’ve already packed up two supermarket bags per recipient.

Sustainable F&B Explained

Sustainable F&B Explained